Egg Price Forecasting

Client: Mister Smith’s Bakery

Overview: Forecasted egg prices using historical economic data to help a local bakery plan ahead, stabilize procurement costs, and avoid sudden customer-facing price hikes.

Business Challenge

Mister Smith’s relies heavily on egg-based ingredients. In late 2024, a price spike forced the bakery to apply a $0.50 surcharge on egg items. This triggered customer backlash and hurt margins. The bakery lacked visibility into upcoming price trends. It needed a way to forecast prices ahead of time and build inventory or pricing strategies proactively.

Key Business Questions

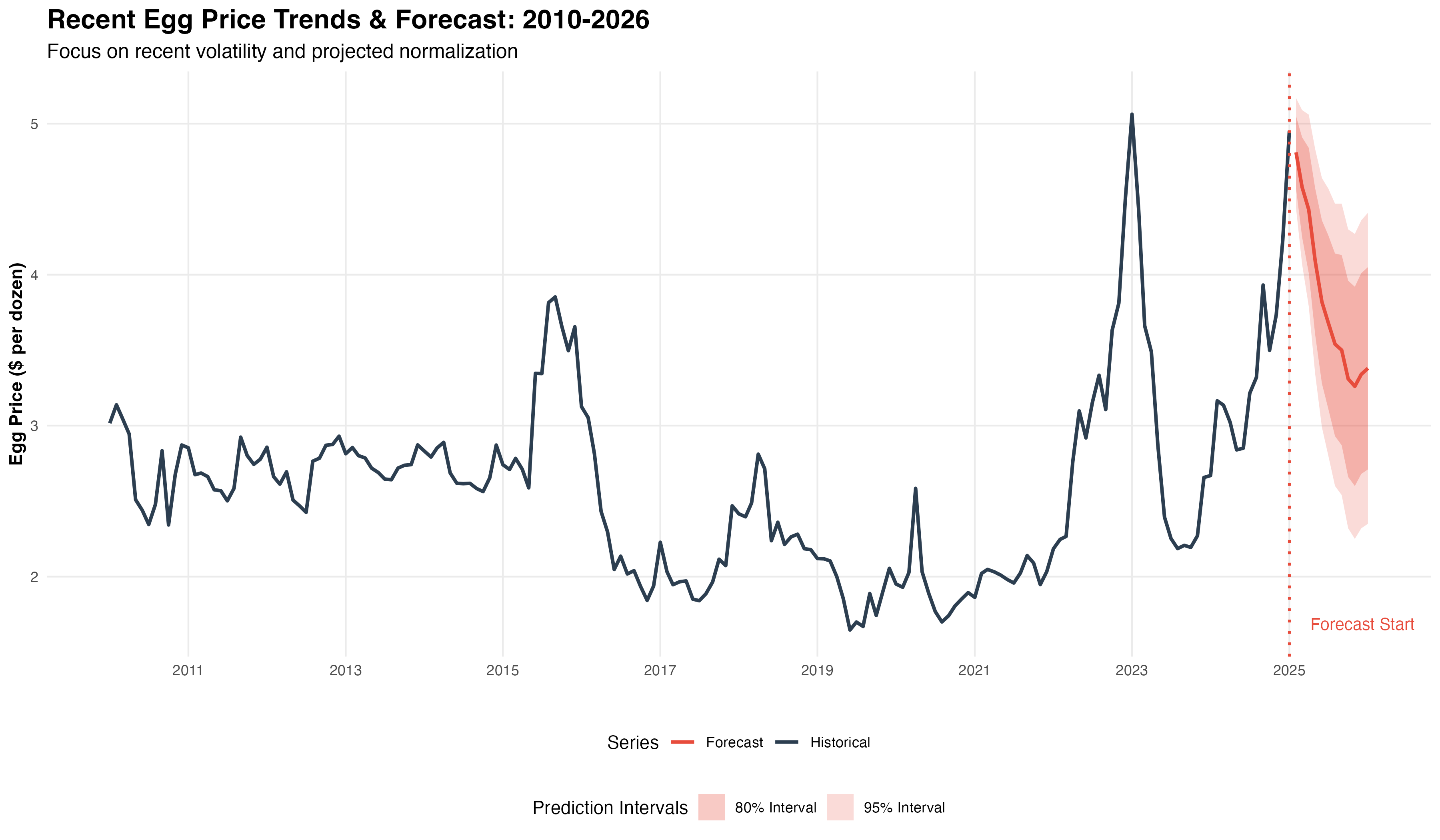

- What will egg prices look like over the next 12 months?

- When are prices most likely to spike?

- What is the forecast range, and how can we plan for volatility?

- Can the model support budgeting and supplier planning?

Data Summary

Data was sourced from FRED (Federal Reserve Economic Data) using:

- Nominal Egg Prices: Monthly U.S. city average (Grade A, Large)

- Egg-Specific CPI: Used to inflation-adjust historical prices

The resulting dataset covers Jan 1995 to Jan 2025 — 360+ monthly records with no missing values.

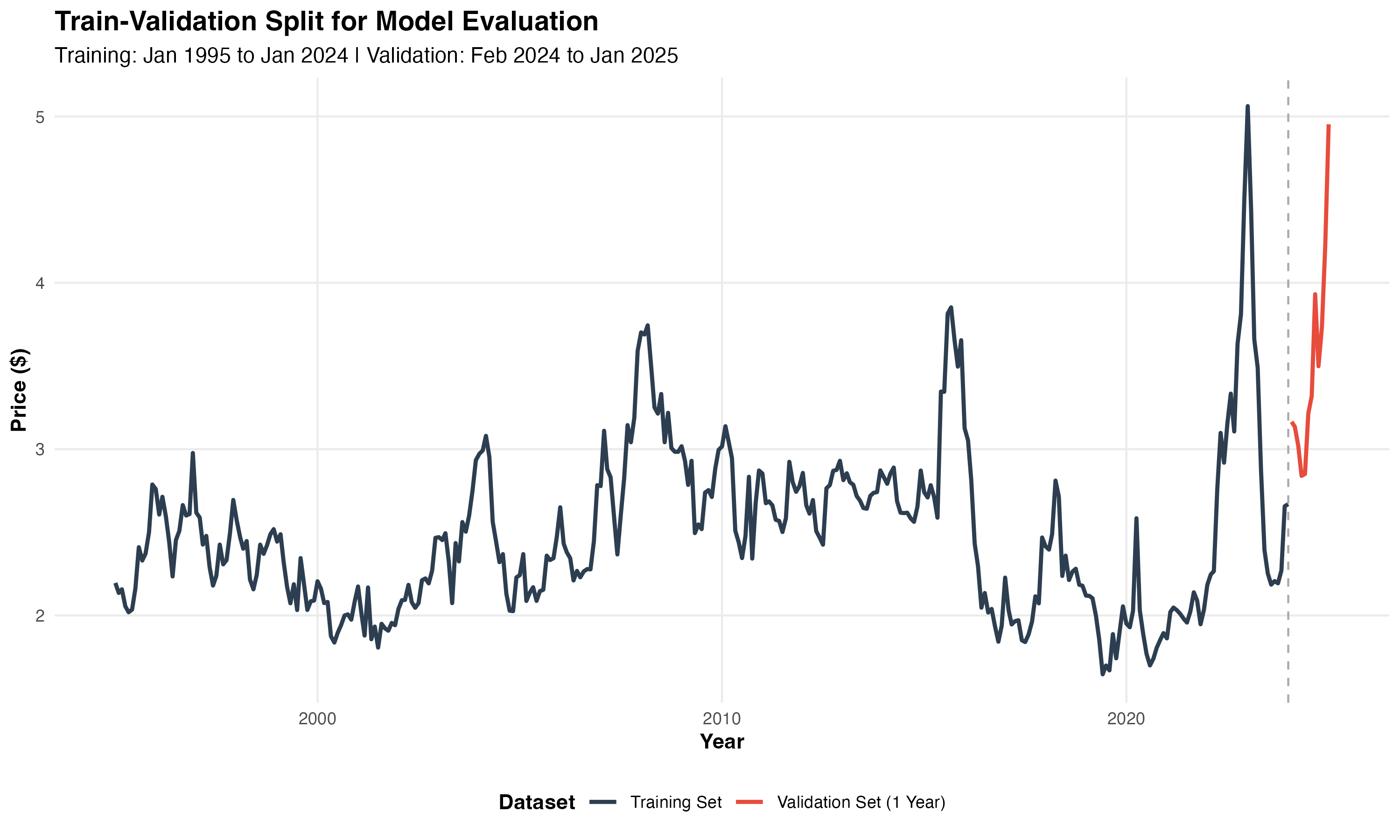

Analytical Approach

The model tested three forecasting approaches:

- Naïve Model

- Exponential Smoothing (ETS)

- ARIMA – selected for final deployment

ARIMA outperformed others on 2024 holdout data. It offered the best balance of accuracy and interpretability under recent volatility.

Key Findings

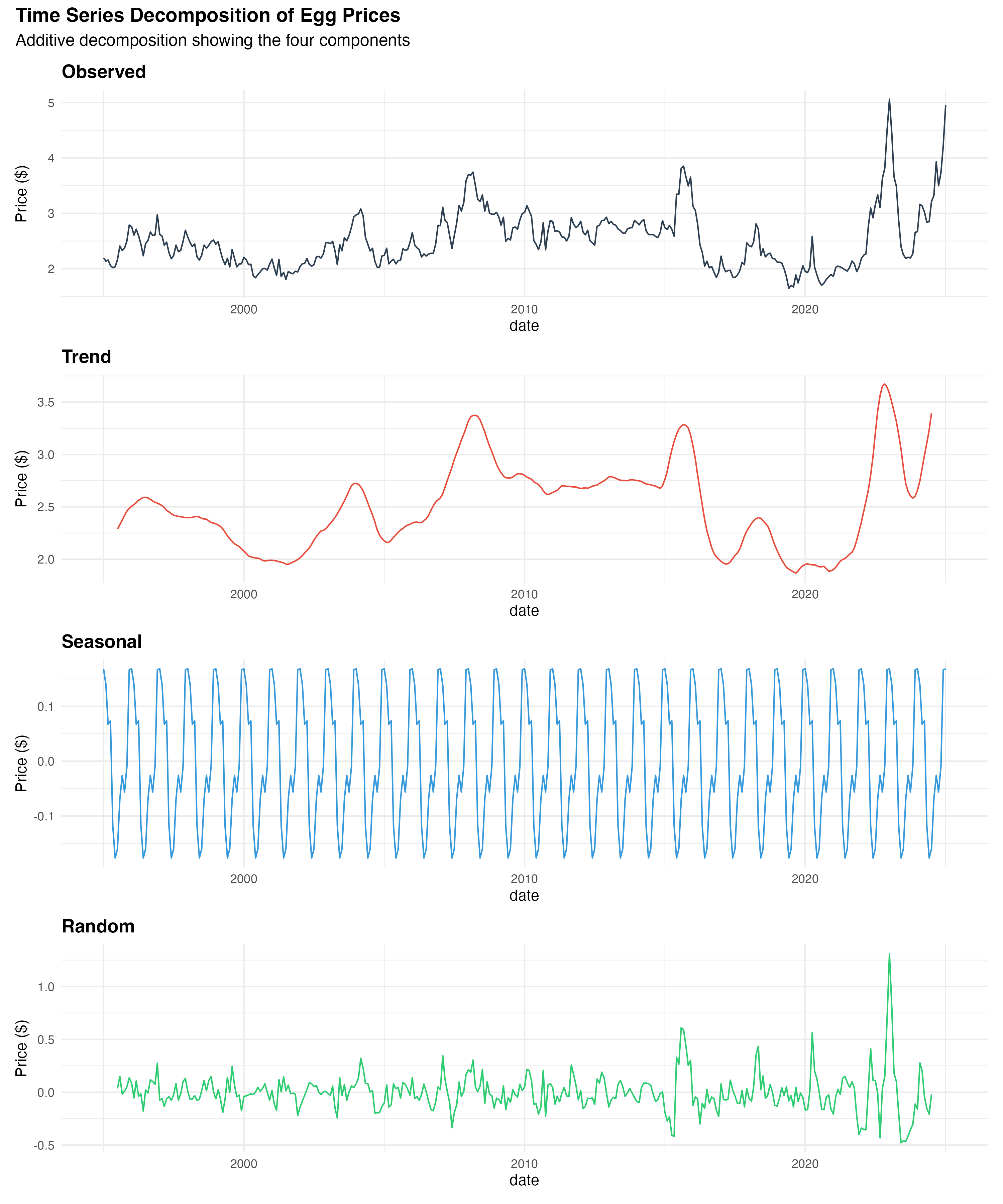

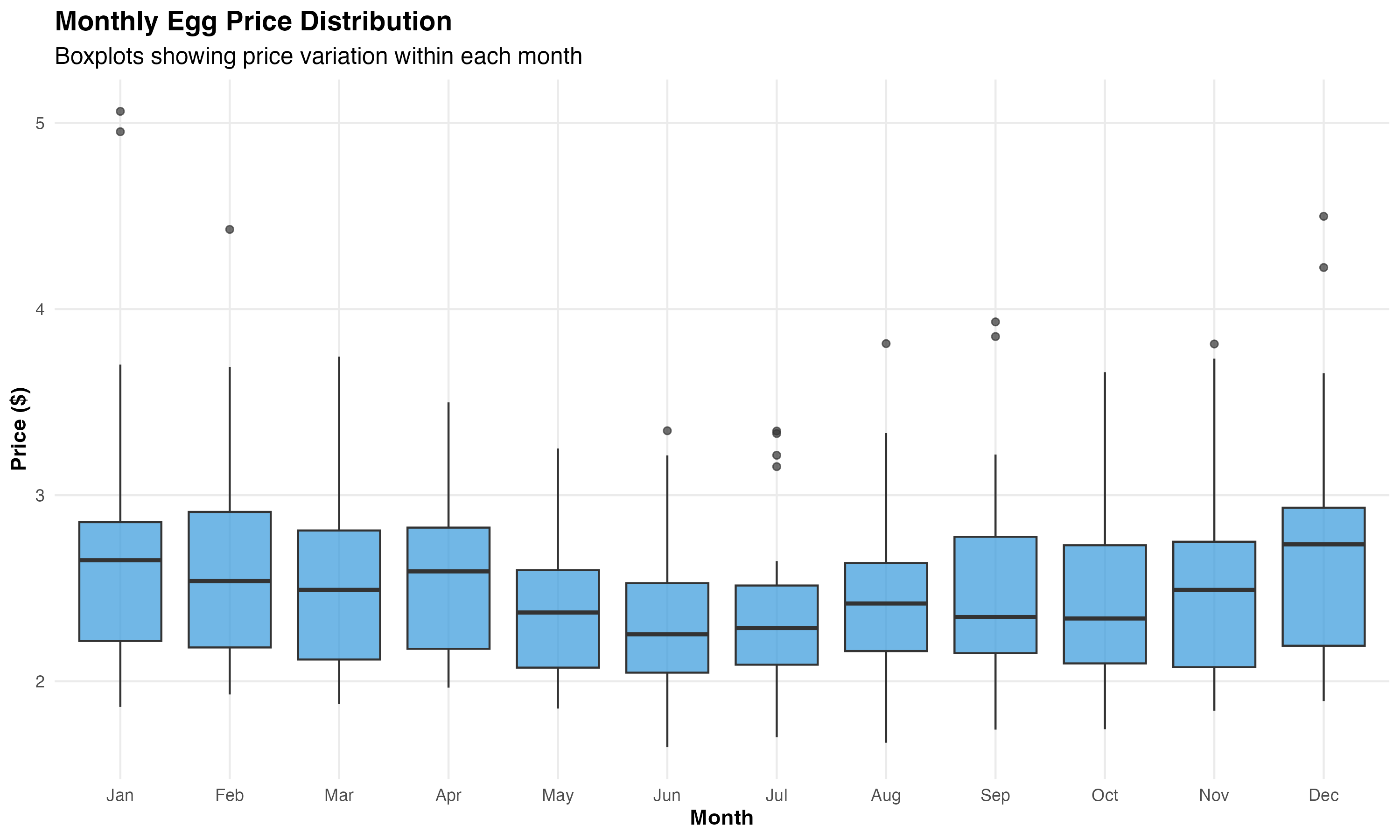

- Winter price spikes are consistent: December–January saw the highest median and most variable prices.

- Recent volatility breaks the pattern: Forecast error increased in late 2024, underscoring post-pandemic instability.

- ARIMA was most reliable: Despite noise, it offered the best generalizable performance.

Business Recommendations

- Order early for Q4–Q1 to avoid spikes: plan bulk egg purchases in advance

- Use $3.40/dozen as a budgeting anchor for 2025–26

- If prices dip below $3.00, secure fixed-rate supply contracts

- If prices approach $4.50, prepare menu adjustments to protect margins

Assumptions & Limitations

- No external predictors (e.g., feed or fuel costs) were included

- Forecast assumes past trends continue — unexpected shocks may reduce accuracy

- Model selected by cross-validation: ARIMA(4,0,0)(2,0,0)[12] without differencing